How Financial Advisor can Save You Time, Stress, and Money.

Wiki Article

The Ultimate Guide To Traditional

Table of ContentsExcitement About SepNot known Factual Statements About Life Insurance Little Known Facts About Traditional.

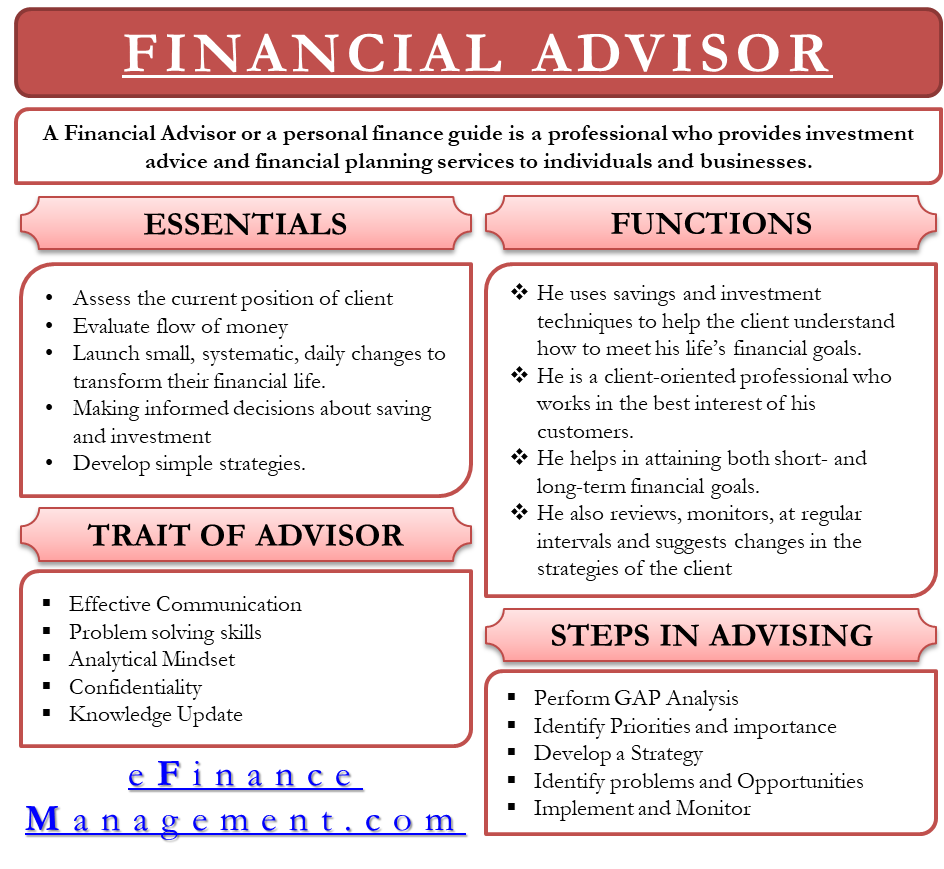

An economic advisor functions as a relied on expert and also overview, utilizing their proficiency and also knowledge of monetary markets to develop customized monetary strategies and approaches that fulfill each customer's distinct requirements and objectives. They function to aid their clients accomplish a stable financial future and also safety and security and also help them navigate intricate financial choices and also challenges.

5 Simple Techniques For Traditional

A financial advisor can aid you address and also manage any type of exceptional financial debts and also establish a technique to come to be debt-free. A financial expert can aid you prepare to distribute your assets after your death, consisting of developing a will check my reference and setting up counts on. A monetary consultant can aid you understand and also handle the threats connected with your financial situation and investments - SEP.

An economic expert can assist customers in making investment choices in several methods: Financial consultants will certainly collaborate with customers to understand their danger tolerance and create a personalized financial investment strategy that aligns with their goals as well as convenience level. Advisors generally suggest a diversified portfolio of investments, including supplies, bonds, and also various other properties, to aid mitigate danger as well as make best use of possible returns.

Financial advisors have considerable knowledge as well as competence in the financial markets, as well as they can assist customers understand the prospective advantages as well as dangers linked with different investment options. Financial advisors will on a regular basis examine clients' profiles and also make referrals for adjustments to ensure they stay lined up with clients' objectives as well as the present market problems (Roth IRAs).

The 9-Minute Rule for 401(k) Rollovers

Yes, an economic expert can aid with debt monitoring. Financial debt administration is essential to total monetary planning, and economic advisors can supply assistance as well as support in this location.

Financial advisors typically get paid in one of several waysMeans Some financial advisors experts gain commission look at here compensation selling financial economic, such as mutual funds, insurance productsItems or annuities. It's important to discover an expert that listens to your needs, recognizes your monetary situation, and has a tried and tested track document of helping customers attain their monetary objectives. In addition, a monetary consultant can assist create a detailed financial strategy, make recommendations for investments as well as take the chance of management, and also offer continuous support and also monitoring to aid make sure clients reach their financial objectives.

Report this wiki page